What is Reconciliation of ITC

Due to a lack of Accounting professionals and cost-cutting measures, small and medium businesses engaged themselves with untrained accounting manpower. Those who couldn’t hire a full-time accountant switched to a part-time accountant who worked on a contract basis.

This resulted in poor quality of accounts maintenance. The financial impact faced by many businesses was on account of loss of Input tax credit for various invoices which were left unaccounted in books. These credits if not availed during the defined time resulted in lapse of Input Tax Credit causing huge losses to businesses.

Reconciliation of these invoices from GST portal with your books and GST returns it ITC Matching.

Have Any Queries? Please write in the comments or mail us at rohit@businesshelpers.in Contact us to know more.

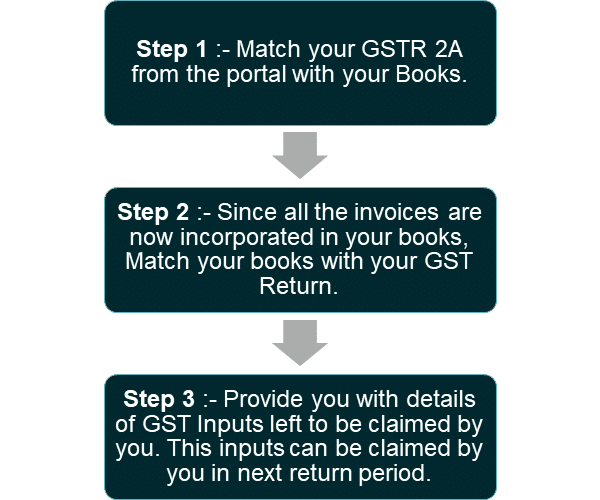

How can You match it

This process is carried out in 3 steps.

Various Parameters to Match

GST requires robust and timely checking of these details. GST Imposes 24% interest on tax on wrong credits availed or credits not reversed on time.

We check your invoices on various parameters.

- Have you accounted for all invoices as mentioned in GST Portal?

- Have you taken input Tax credit for the accounted Invoices?

- Whether credit has been taken under the right head i.e. SGST, CGST, and IGST?

- Whether the correct amount of ITC has been entered?

- Is any invoice entered twice in books and credit wrongly availed twice?

- Has your supplier uploaded the invoice on the GST portal?

- Have you accounted for all debit and credit notes?

- Have you availed of any wrong credit?

- Have you missed any genuine credit?

- Have you paid adequate RCM?

- Have you taken ITC of RCM paid?

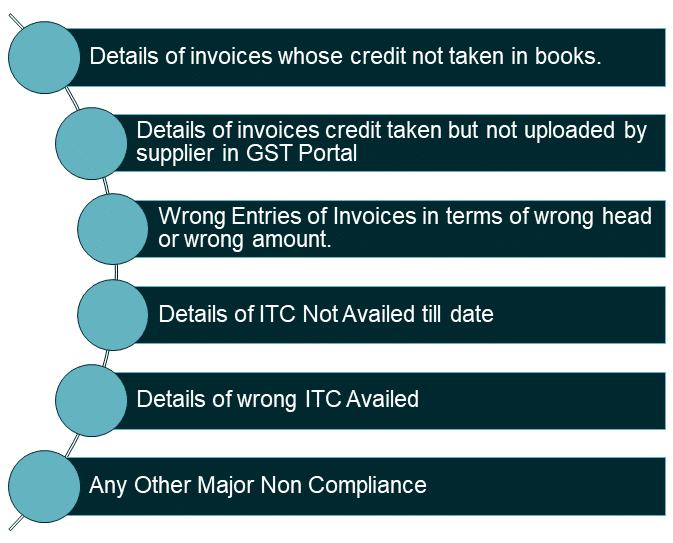

Outcomes to be Checked

Once the Matching is complete, the outcomes would be based on following parameters

How can we help you

Owners are already occupied in business activities and rely on work done by accountants. This results in a loss of huge Tax credits to businesses. We, as professionals can provide you with the requisite results in a very cost-effective pricing.

We already support Accounting in Tally, MARG ERP, Busy Accounting and Online Accounting Software’s such as Quick Books and Zoho Books.

Get 10% off on all our services

All our new customers get a 10% Discount on all the services available. Just fill in this form.

Being a Professional Service provider, We Do not harass you by spamming.

Click here to Fill the Form to contact us

Pricing and Plans

GST matching is time-consuming and requires professional skills and knowledge of GST Law. Our Plans are this catered based on the amount of time dedicated and financial viability to the Business. Our Simple Pricing plans are based on the number of Invoices to be matched.

GST to be charged Extra on Billings.

Payment terms : 40% Advance, 40% upon completion of work and 20% upon submission of reports.

About Us

Business Helpers is an Online Accounting, Business and Tax consultancy firm providing services PAN India. We help our clients from starting their businesses to successfully managing it enabling their growth and success.

Our aim to prove the best services at the most affordable cost. We are a group of dedicated professionals, qualified and experienced visioning towards a more compliant India.

We believe not only in providing services but to educate our clients with all the business and legal changes happening every day. Our endeavor is to break the professional boundaries and maintain a personal touch with our clients.

We take the utmost care to provide high-quality services to our clients to their full satisfaction.

Click here to download the detailed proposal

A Consultant Always saves you more money then what you pay him

Still having doubts? Comment your query Below or Write your query to us at rohit@businesshelpers and we will try to resolve it for Free.